Education Center / LCFS Credits Benefiting Electric Fleets

Blog

Category: Electric Charging, Low Carbon Fuel Programs

LCFS Credits Benefiting Electric Fleets

Across the United States, organizations are benefiting from low carbon fuel programs: the federal RFS, California’s LCFS, and Oregon’s CFP. Under each of these standards, state and local governments have incentivized the adoption of alternative fuels—meaning fleets and organizations alike can get paid for using clean fueling alternatives. While many fleets are currently benefiting from credit generation services, others remain skeptical—questioning whether this service is too good to be true. Or, whether they’re receiving the most value from their current provider.

The reality? Fleets that overlook low carbon fuel programs are missing out on a new, sizable revenue stream. Credit generation programs were started to support the role alternative fuels have in decarbonizing operations, help fleets align with stated emission reduction goals, and improve air quality in high pollution areas. As more fleets embrace the role electric vehicles have within their operations, CFP and LCFS credits can help justify a transition. Keep reading to learn how much revenue your organization could earn by using electric transit buses, yard trucks, school buses, and lifts.

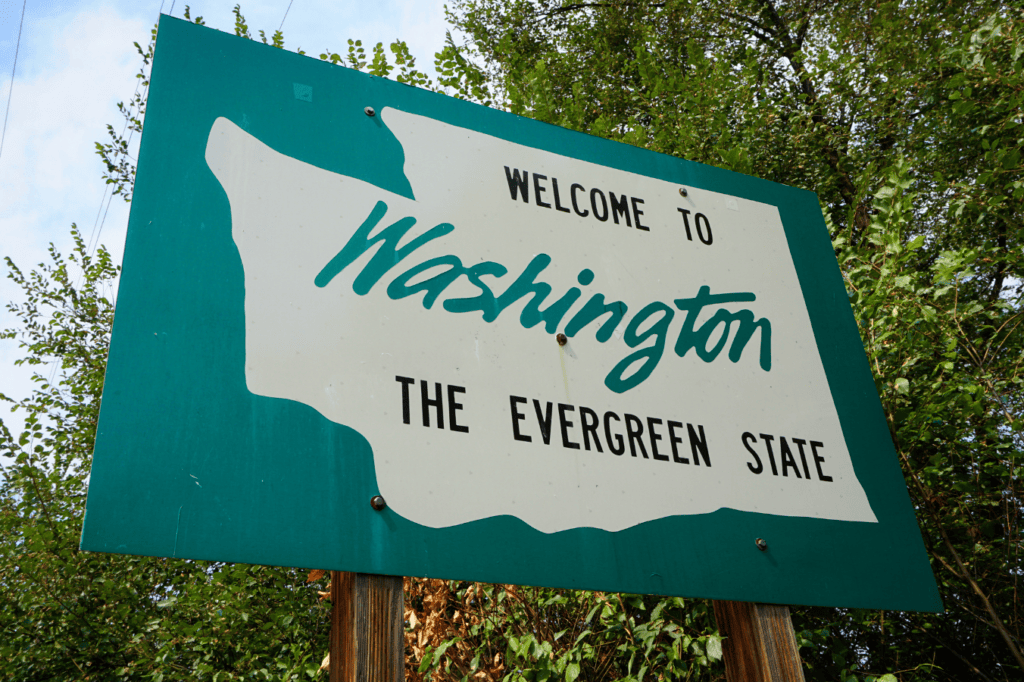

ELECTRIC CREDIT GENERATION: REGIONAL VARIANCES

Determining whether your fleet can get paid for using electric vehicles depends greatly on the region you’re in. Currently, (aside from grant funding) fleets can only get paid to use electric vehicles in California and Oregon—thanks to their low carbon fuel programs. Washington may be close behind with their Clean Fuel Standard (CFS)—set to launch in January 2023.

At the federal level, electric vehicle credits won’t be available until the United States Environmental Protection Agency (EPA) adds eRINs to the federal RFS—incentivizing the production of renewable electricity. However, at the 2022 ARGUS: Biofuels, LCFS, and Carbon Markets Summit, the EPA Director of the Fuel Center announced that electric guidance will be included in their November 2022 information packet.

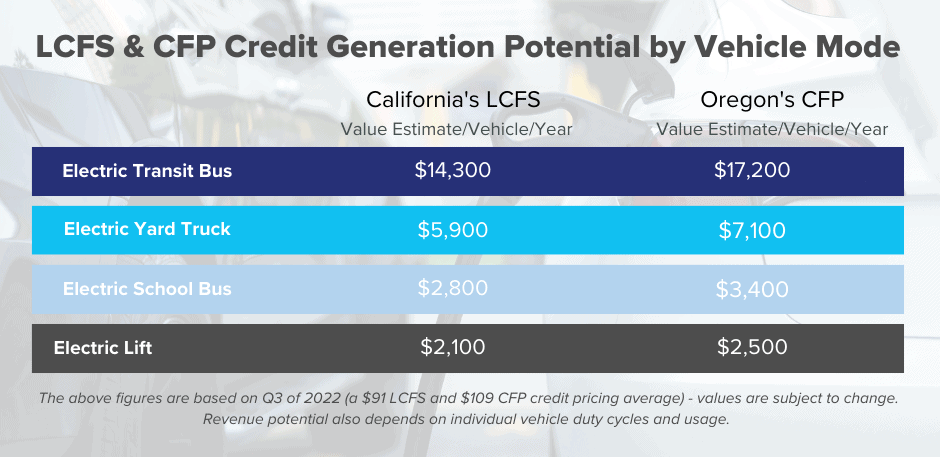

While California and Oregon both currently incentivize fleets for using electric vehicles, the value organizations receive from CFP and LCFS credits vary—especially depending on vehicle type and use case. In the below table, fleets can begin to understand how much revenue they could be earning per electric vehicle annually. Let’s break down each vehicle type further.

1 | ELECTRIC TRANSIT BUSES

With over 63,000 transit buses in the United States and emerging zero emission regulations, electric bus vehicle manufactures such as BYD, Proterra, and AB Volvo are seeing an increase in demand. As of December 2020, there were 1,268 electric transit buses in operation across the United States—accounting for just under 2% of all transit buses. However, fourteen states have since adopted California’s ZEV program and low-emission vehicle (LEV) standards—resulting in an increased demand for zero tailpipe emission vehicles.

For many fleets, the initial conversion costs may be a barrier to adoption, but it doesn’t have to be. Through the U.S. Bipartisan Infrastructure Law, $1.66 billion in grants will go to transit agencies—supporting up to 150 bus fleets and facilities. Over 1,100 of the buses within these fleets will use zero-emission technology: whether that be battery electric or hydrogen fuel cell.

Specific to use case, the U.S. Department of Energy reported that on average, a transit bus drives 43,647 miles annually. This duty cycle allows transit fleets to earn substantial revenue: up to $14,300 from California’s LCFS credits or $17,200 from Oregon’s CFP credits. Whether that’s used for purchasing more vehicles and additional chargers or reinvesting back into their bottom line, adopting electric buses can be a strategic decision for transit agencies.

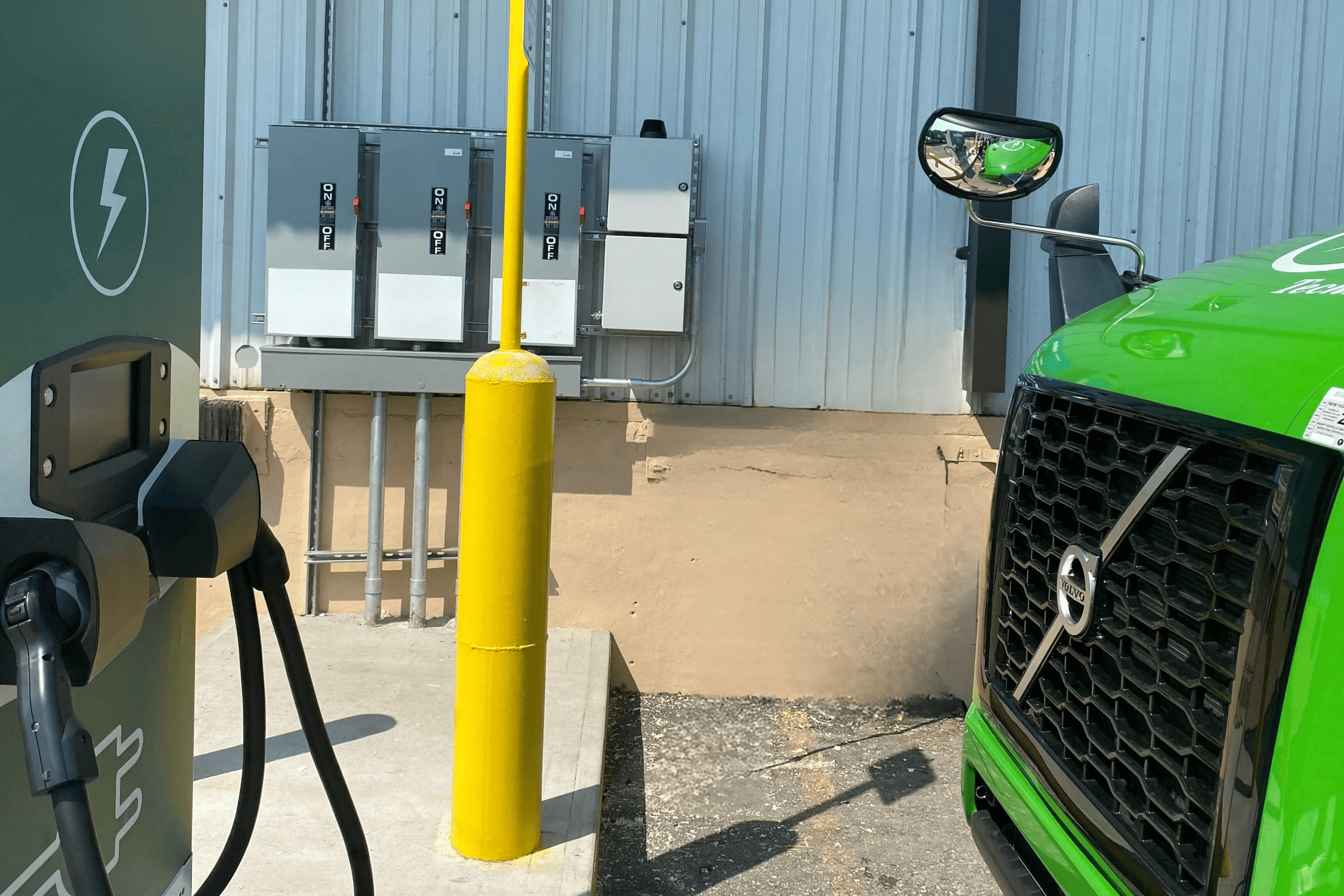

2 | ELECTRIC YARD TRUCKS

If you have a fleet of yard trucks, vehicle manufacturers such as Orange EV, Kalmar Ottawa, and BYD should be on your radar as they continue to build out their electric lines. It’s estimated that there are roughly 60,000 yard trucks in operations across the U.S.—15,000 of which operate within our ports. But how many of these are electric? As of April 2022, there were said to be 400 electric yard trucks in operation across the United States.

With key policies and regulations in place to decarbonize port traffic and warehouse operations, electric yard trucks offer a viable solution. Paired with the potential to receive up to $5,900 from LCFS credits or $7,100 from CFP credits, electric yard trucks provide lower operating costs than their diesel counterparts and pair well with low-speed, frequent start-stop operations.

3 | ELECTRIC SCHOOL BUSES (ESBS)

There are ~480,000 school buses across the United States—over 95% of which run on diesel, although, this is beginning to change. School districts are prioritizing the adoption of alternative fuels, inclusive of electric school buses (ESBs). From Thomas Built to Blue Bird, Lion Electric, and IC Bus, fleets have options as to what electric models will work best for their needs and connect them with the greatest funding opportunities. There are over 24,200 school buses across California and more than 7,400 school buses in Oregon. With each school bus driving an average of 12,000 miles per year, the revenue potential for districts is very real.

As of June 2022, 38 U.S. states had committed to 12,275 electric school buses—roughly 2.5% of the total U.S. school bus footprint. In this context, a committed ESB means a district has been awarded funding to purchase a bus, a formal purchase agreement has been made, or the buses have been delivered and are currently in operation. However, of these buses, only 5% (~600) have been delivered or are currently in operation.

California is leading the charge with just over 1,000 committed buses. Of all the state’s school districts, Moreno Valley USD’s deployment of 42 electric school buses has made it the largest electric school bus fleet in California as of June 2022. Not only will this help them reduce more than 1.2 million pounds of carbon emissions across Moreno Valley, but the district expects 75% cost savings across their bus maintenance, fuel, and operations spend—cost savings that U.S. Energy will help them capitalize on through credit generation.

Under California’s LCFS, fleets can earn up to $2,800 per bus annually while the CFP enables fleets to generate up to $3,400 per bus every year. This leaves districts to reinvest the revenue as they see fit—whether to strengthen school curriculum, support driver retention, or facilitate the rollout of more ESBs.

4 | ELECTRIC LIFTS

As noted above, ports and warehouses are under immense pressure to decarbonize their operations: including a focus on off-road transportation. There are an estimated 855,900 forklifts in operation across the United States: running on conventional fuels including liquid petroleum gas (LPG), compressed natural gas, gasoline, and diesel as well as emerging solutions such as electric and hydrogen. From the North American perspective, roughly 64% of the lift truck market is electric. But aside from producing zero tailpipe emissions, what’s the appeal?

Organizations can get paid for using electric lifts—earning up to $2,100 per lift from LCFS credits and $2,500 per lift from CFP credits. While alone, the value per lift is less than the prior examples, the revenue can quickly compound. U.S. Energy helped Tire’s Warehouse generate $150,000+ per year from their fleet of 85+ e-lifts.

“I never would have guessed the value that could be derived from participating in credit generation. Simply by using an existing fleet of vehicles, this process affords organizations the ability to reinvest earnings back into their organization as a profit,” shared Brad Uptgraft, director of operations at Tire’s Warehouse.

DETERMINE YOUR FLEET’S CREDIT POTENTIAL

While above we provided a snapshot of the revenue electric vehicles could bring to your organization, the true dollar amount depends on your unique operations, geography, and use case. Whether you’re curious about what that revenue potential could be for your fleet or looking for a competitive offer, we’re here to guide you through the process and will manage all the behind-the-scenes work (and paperwork) for you. From vehicle and charger selection to data monitoring and reporting, we’ll help maximize your credit potential—monetizing credits on your behalf. Reach out to get started.